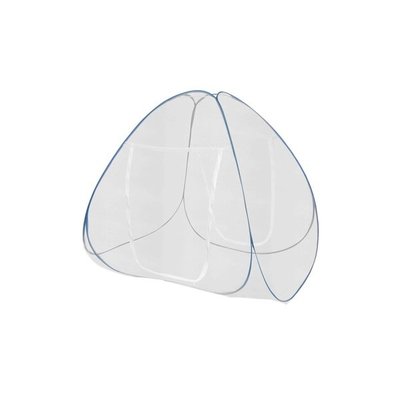

Portable Large Instant Pop Up Camping Mosquito Net Netting Insect Tent Camping Canopy Indoor Outdoor - Buy Automatic Pop Up Tent,Outdoor Screen Room House,Big Canopy Tent Product on Alibaba.com

Pop-up klamboe voor een tweepersoonsbed, grote draagbare tent reizen dubbele deur rits bednet, eenvoudige installatie, fijn gaas, voor slaapkamer outdoor camping, | Fruugo NL

Klamboe Opvouwbare Tent Reizen Luifel Bed Frame Installatie Gratis Student Tent Automatische Pop Up Mongoolse Yurt Klamboe|Klamboe| - AliExpress