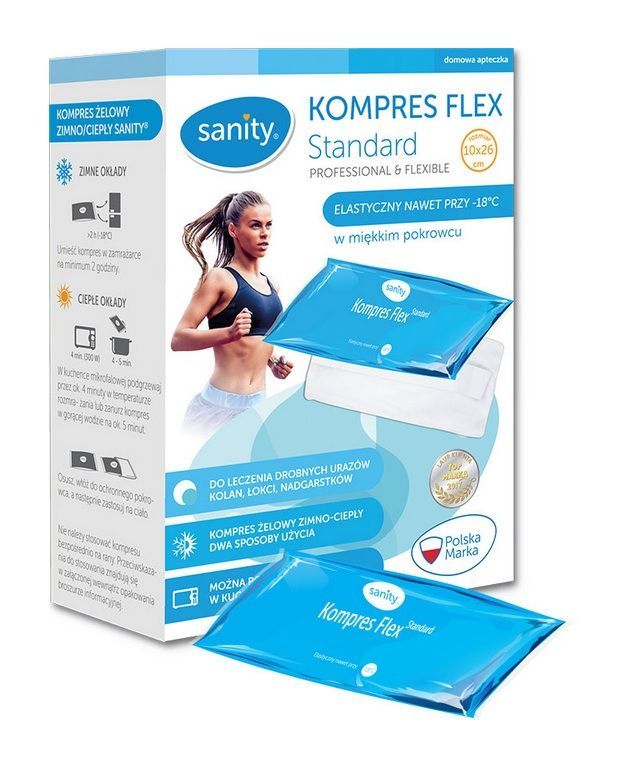

Sanity Kompres żelowy zimno-ciepły Flex Standard 10 x 26 cm | Gorączka | Ból | 1 sztuka - Ziko Apteka

Okład - kompres żelowy zimny-ciepły wielokrotnego użytku Mueller Sklep sportowo medyczny Sportmed24.pl

Kompres żelowy SANITY FLEX MEDIUM zimno-ciepły 21 x 22 cm (1 szt) - cena - Apteka Internetowa Tanie-Leczenie

Visiomed KINECARE 11x35 cm Kompres na kostkę, nadgarstek i łokieć do termoterapii ciepło-zimno | Apteczka24.pl

Zimno / ciepły kompres, okład żelowy 28x34cm - Terapia ciepłem - Termoterapia - Terapie - Sklep Medyczny i Zielarski dlapacjenta.pl

Armedical Okład / kompres żelowy zimno-ciepły / plastry żelowe ciepło/zimno (mini 10x10, classic 10x25, maxi 20x30 cm)

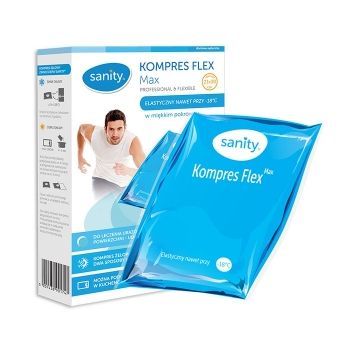

Sanity Kompres żelowy zimno-ciepły Flex Max 21 x 30 cm | Ból | Gorączka | Okład |1 szt - Ziko Apteka