OUTLET Weiße Damen-Sneaker mit grünem Glitzer-Einsatz Jemen - Schuhe - | Royalfashion.de - Online-Schuhgeschäft

THE BEST 10 Shoe Stores near Boelckestraße 4, 55252 Wiesbaden, Germany - Last Updated August 2023 - Yelp

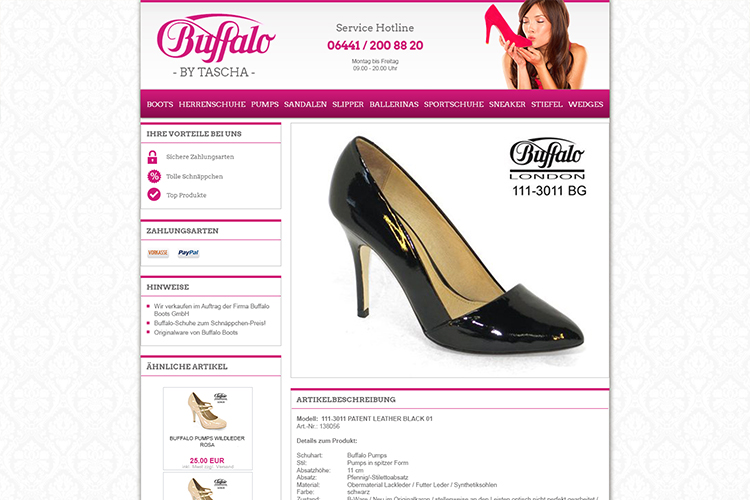

BUFFALO BOOTS - Hohe Str. 30, Köln, Nordrhein-Westfalen, Germany - Shoe Stores - Phone Number - Yelp