&quality=40)

Fjällräven Fleecejacke Buck Fleece (Grün) - Jacken - Bekleidung für Herren - Bekleidung - Jagd Online Shop | FRANKONIA

&quality=40)

Pinewood Fleecejacke Prestwick (Oliv / Braun) - Jacken - Bekleidung für Herren - Bekleidung - Jagd Online Shop | FRANKONIA

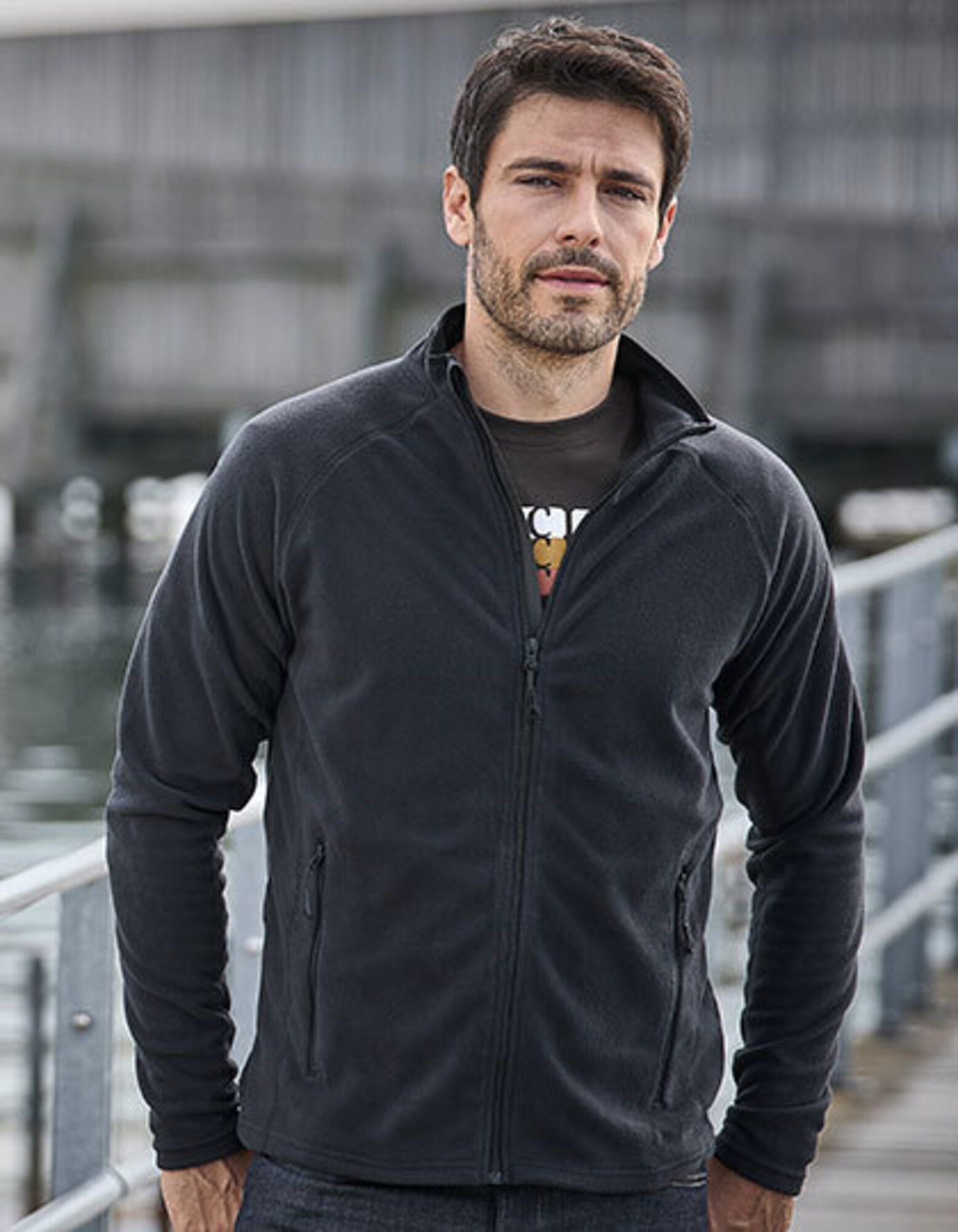

Columbia Herren Fleece-Jacke, Mit durchgehendem Reißverschluss, Fast Trek Light : Amazon.de: Fashion