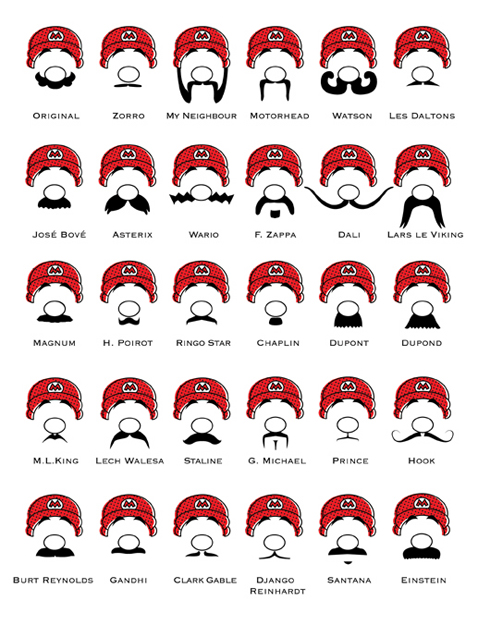

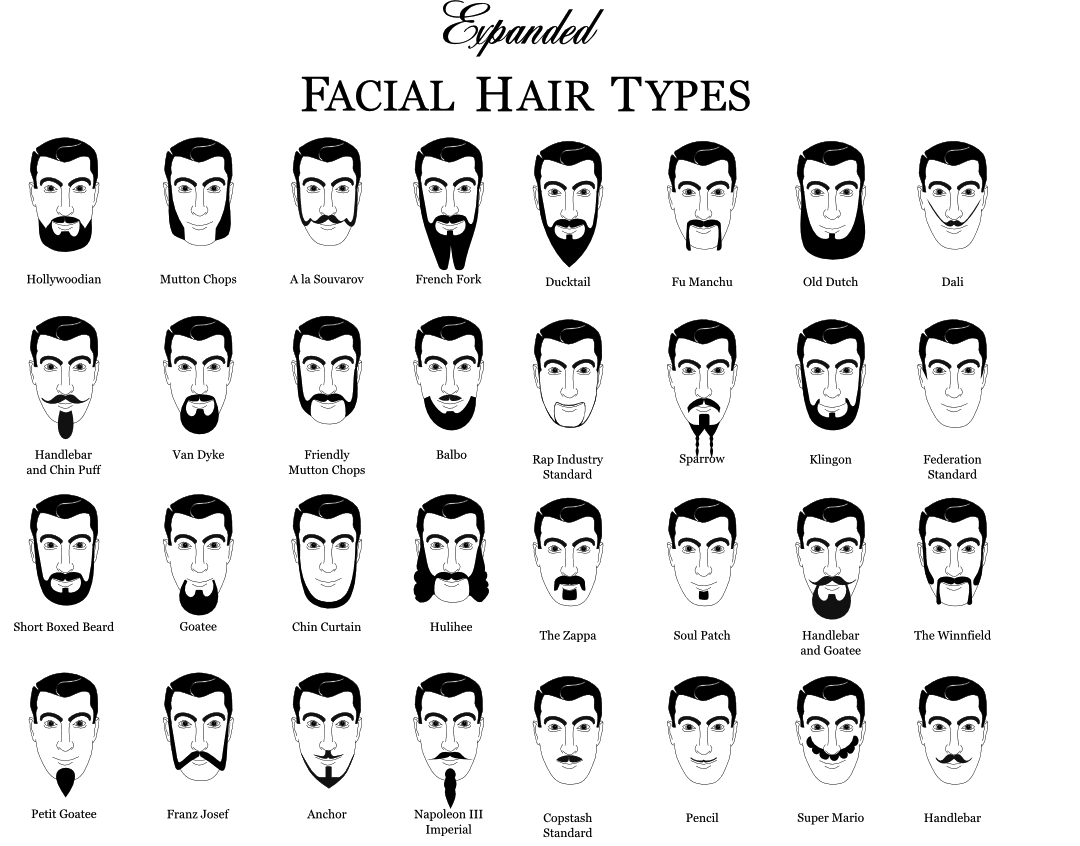

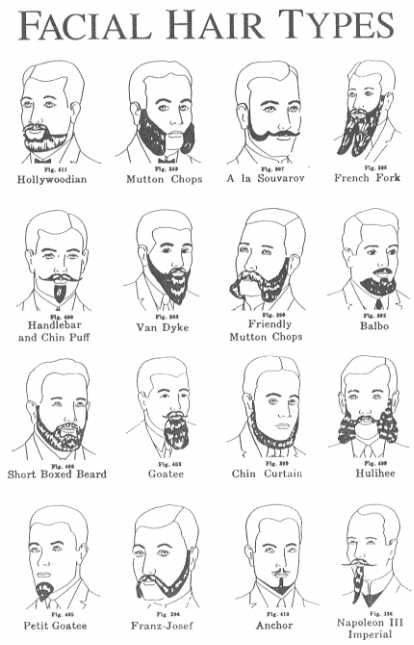

Aby muži vousy slušely, musí zvolit správný střih. S výběrem pomůže tvar obličeje • Styl / inStory.cz

Typy vousů a účes pro muže. portrét moderní módní chlap. fototapeta • fototapety holičství, fotogenický, bederní | myloview.cz

20 typů mladistvých a dospělých vousů se stylem (s fotografiemi) / Obecná kultura | Thpanorama - Udělej si dnes lepší!

Mans typy módní účesy pro holičství. izolované sbírka obsadí fototapeta • fototapety fotogenický, Garibaldi, bederní | myloview.cz

.jpg)